flow through entity canada

Canadas quirky tax innovation. For Canadian income tax purposes ULCs are treated as regular corporations subject to Canadian tax on their worldwide income.

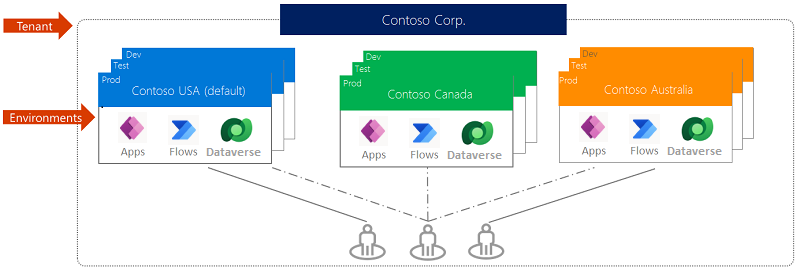

Environments Overview Power Platform Microsoft Docs

Is S corp a pass-through entity.

. Unlimited Liability Corporation - ULC. In Canada however investment corporations whether mortgage trust mutual fund or partnership are regarded as flow-through entities. They file an informational federal return Form 1120S but no income tax is paid at the.

Flow Through Entities Owned by Residents of Canada. A flow-through limited partnership is an equity investment in a portfolio of flow-through shares of Canadian resource companies. Shares issued directly by a resource company and flow-through LP units.

That is the income of the entity is treated as the income of the investors or owners. There are two types of flow-through investments. In the United States certain business entities such as Limited Liability Companies LLC or subchapter S.

Issued by entities that purchase a. Flow-through shares are a financing tool available to a Canadian resource company that allows it to issue new equity shares to investors at a higher price than it would receive for normal. It is considered a flow through entity for tax.

This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain. If you make a withholdable payment to a flow-through entity that is not one of the types described above you must treat the partner beneficiary or owner as applicable of the flow. What is a flow-through limited partnership.

Flow-through shares have generated billions for mining exploration and contributed to the development of some of. The Advantages of an S Corporation in Canada. However for US tax purposes ULCs may be treated.

S corps are pass-through taxation entities. Canadian residents doing business in the United States should only consider direct ownership of a flow through entity once they have become non residents of Canada. Flow through entity canada.

It is considered a separate entity for legal purposes in the US and Canada. A corporate structure that permits a company to be incorporated and flow all profits and losses to shareholders. A flow-through entity is a legal entity where income flows through to investors or owners.

The information in this section also applies if for the 1994 tax year you filed Form T664 Election to Report a Capital Gain on Property Owned at the.

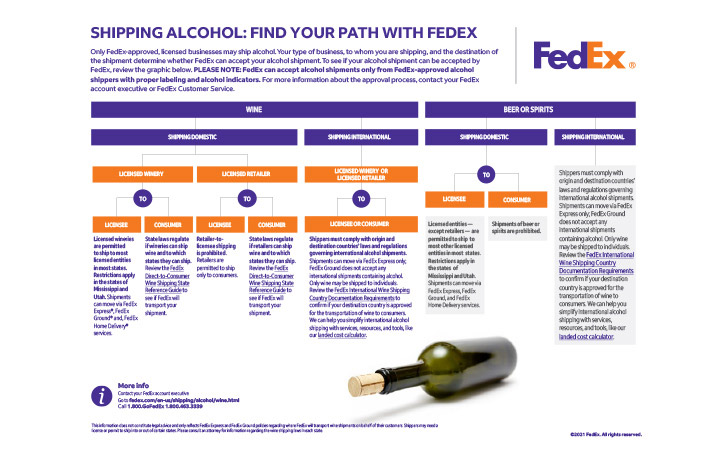

How The Oil And Gas Industry Works

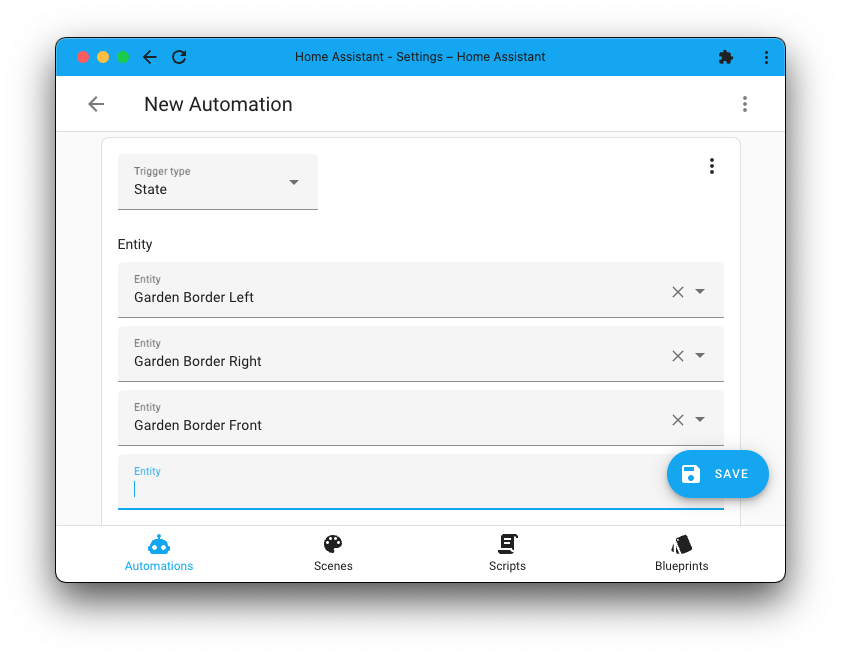

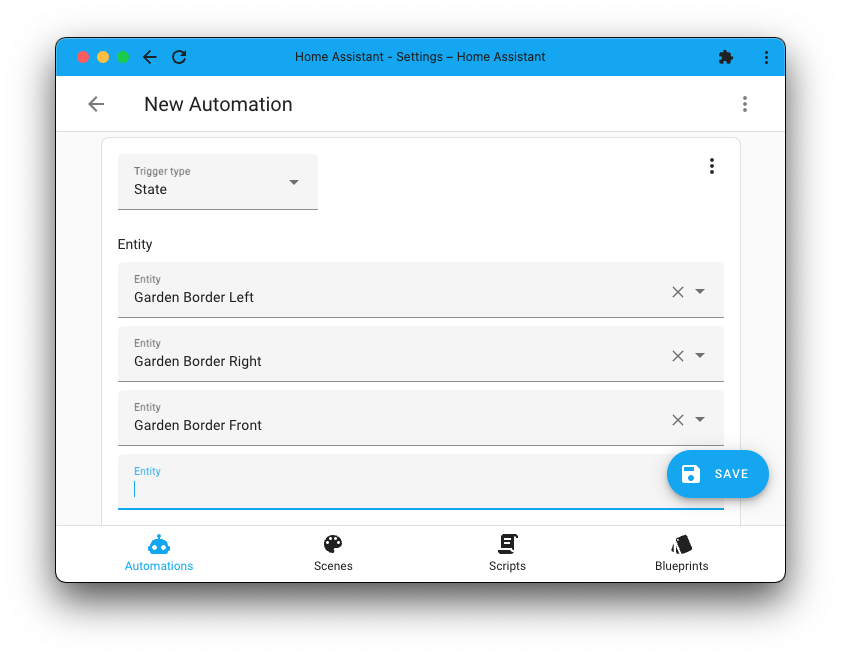

2022 5 Streamlining Settings Home Assistant

:max_bytes(150000):strip_icc()/Accounting-FINAL-21a54d4bbec04561895818faed7a5f82.png)

Accounting Explained With Brief History And Modern Job Requirements

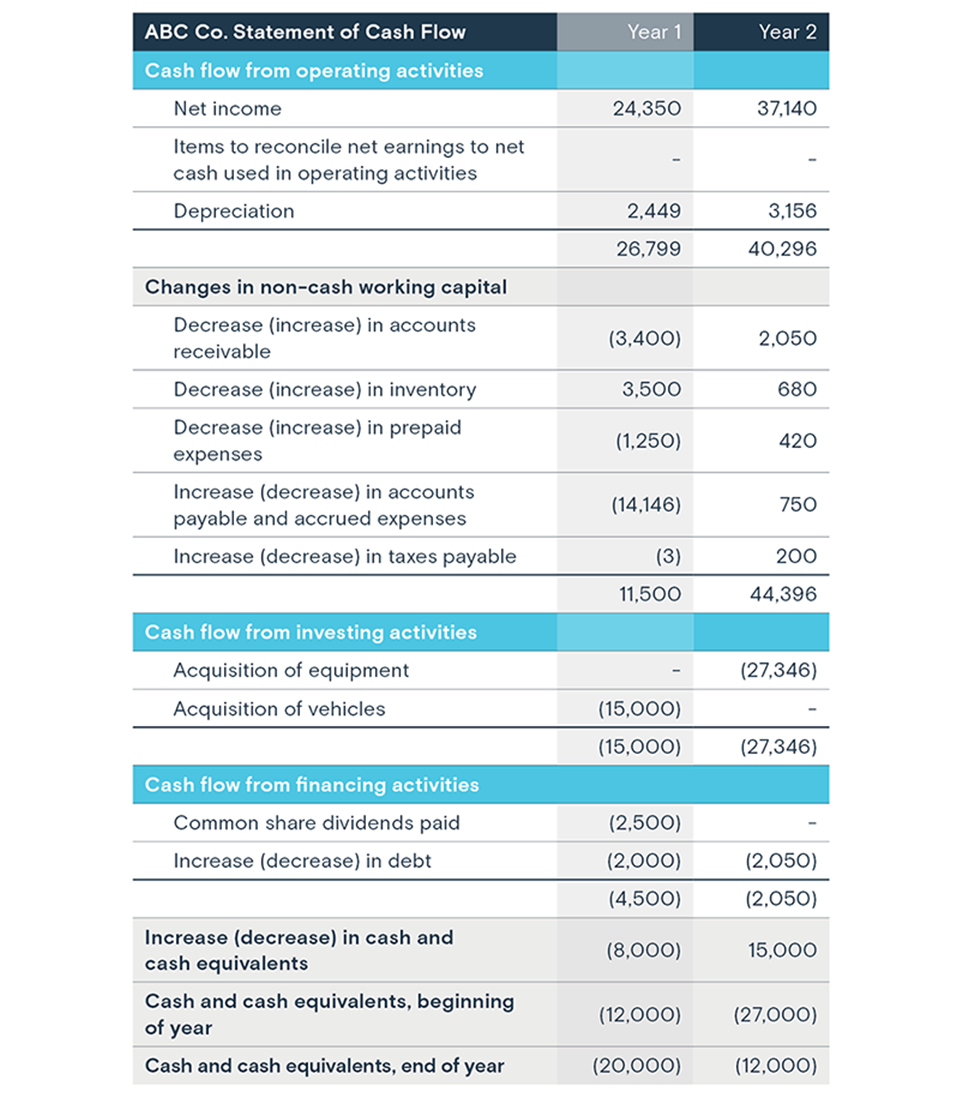

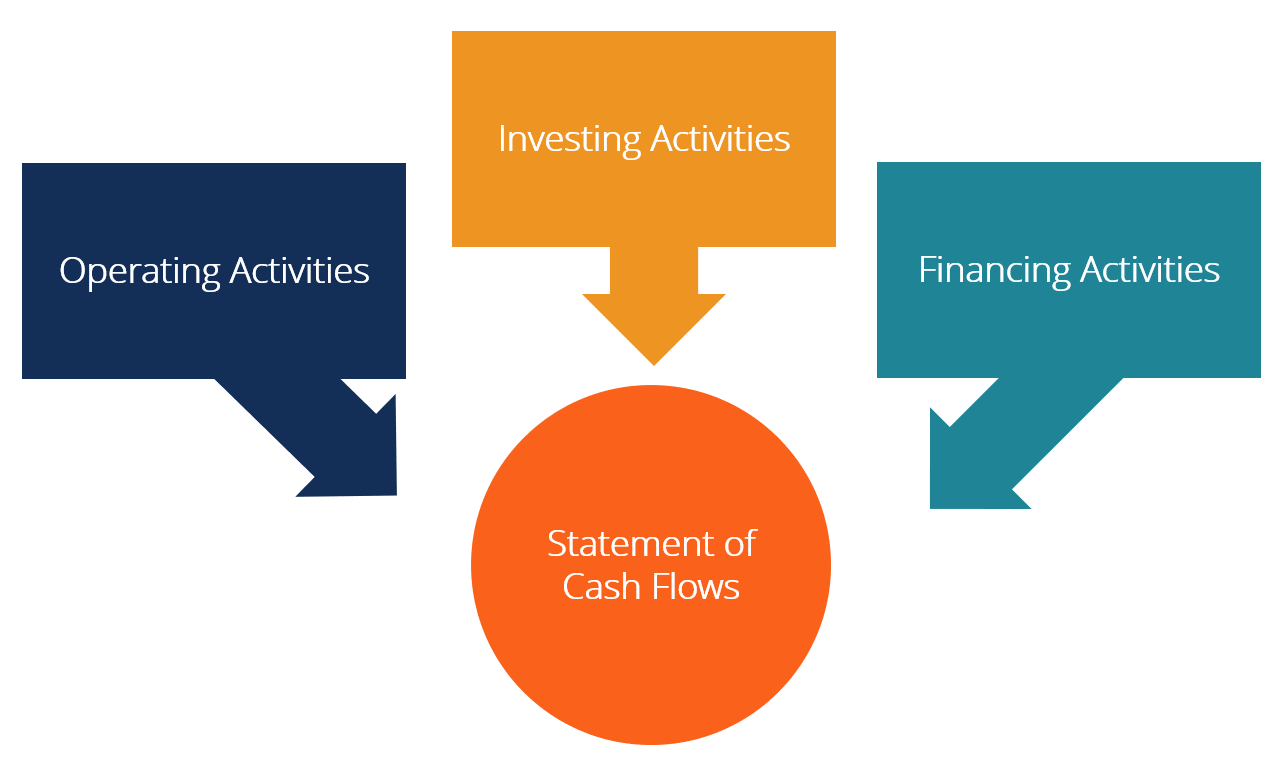

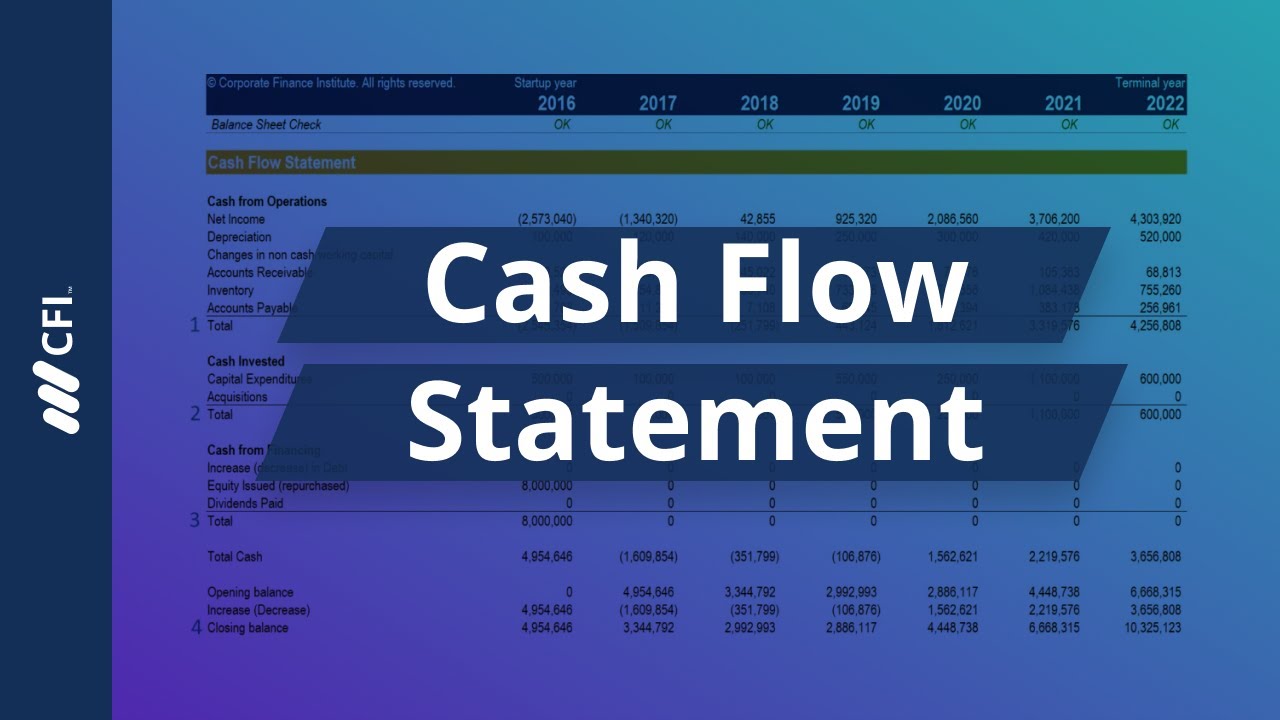

Statement Of Cash Flows How To Prepare Cash Flow Statements

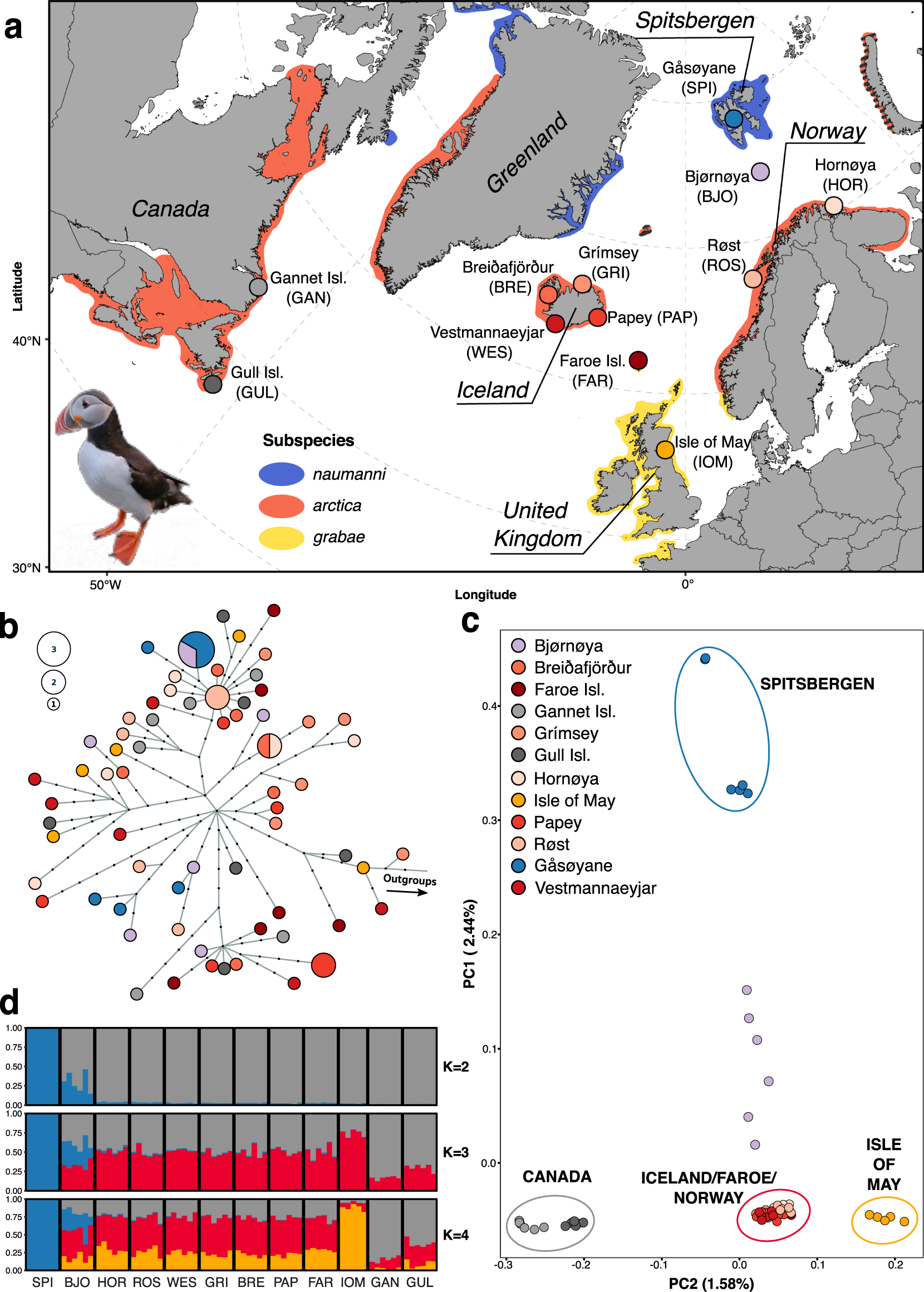

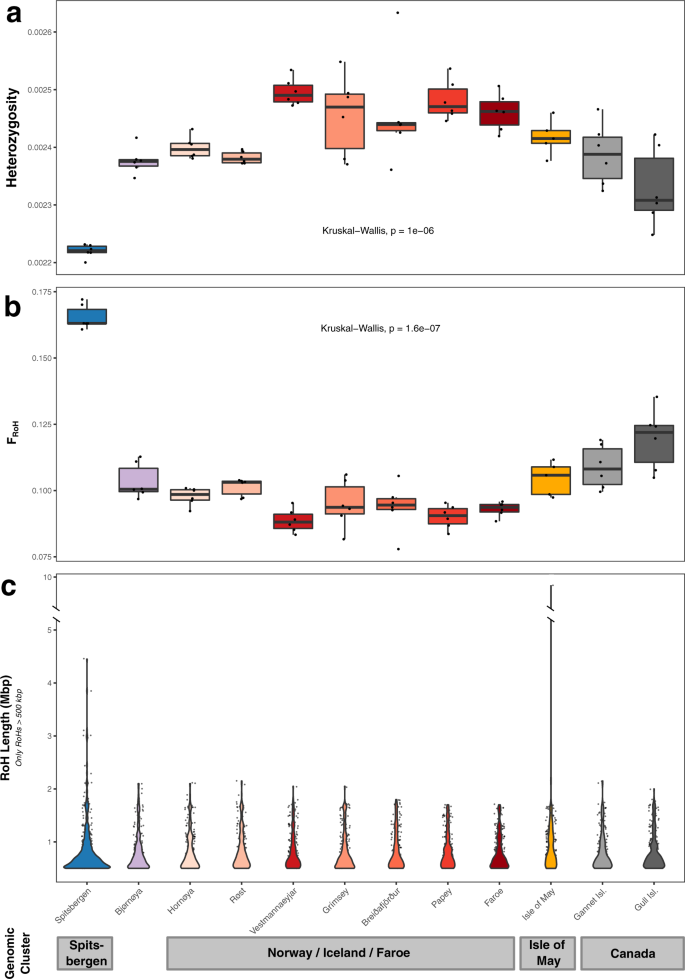

Complex Population Structure Of The Atlantic Puffin Revealed By Whole Genome Analyses Communications Biology

14 Management Characteristics Of Nims Emsi

Limited Liability Partnerships 4 Benefits Of Forming An Llp Starting Up 2022

State Pass Through Entity Taxes Dbriefs Webcast Deloitte Us

New York State Pass Through Entity Tax Election Period Is Open For 2022 Wolters Kluwer

Statement Of Cash Flows How To Prepare Cash Flow Statements

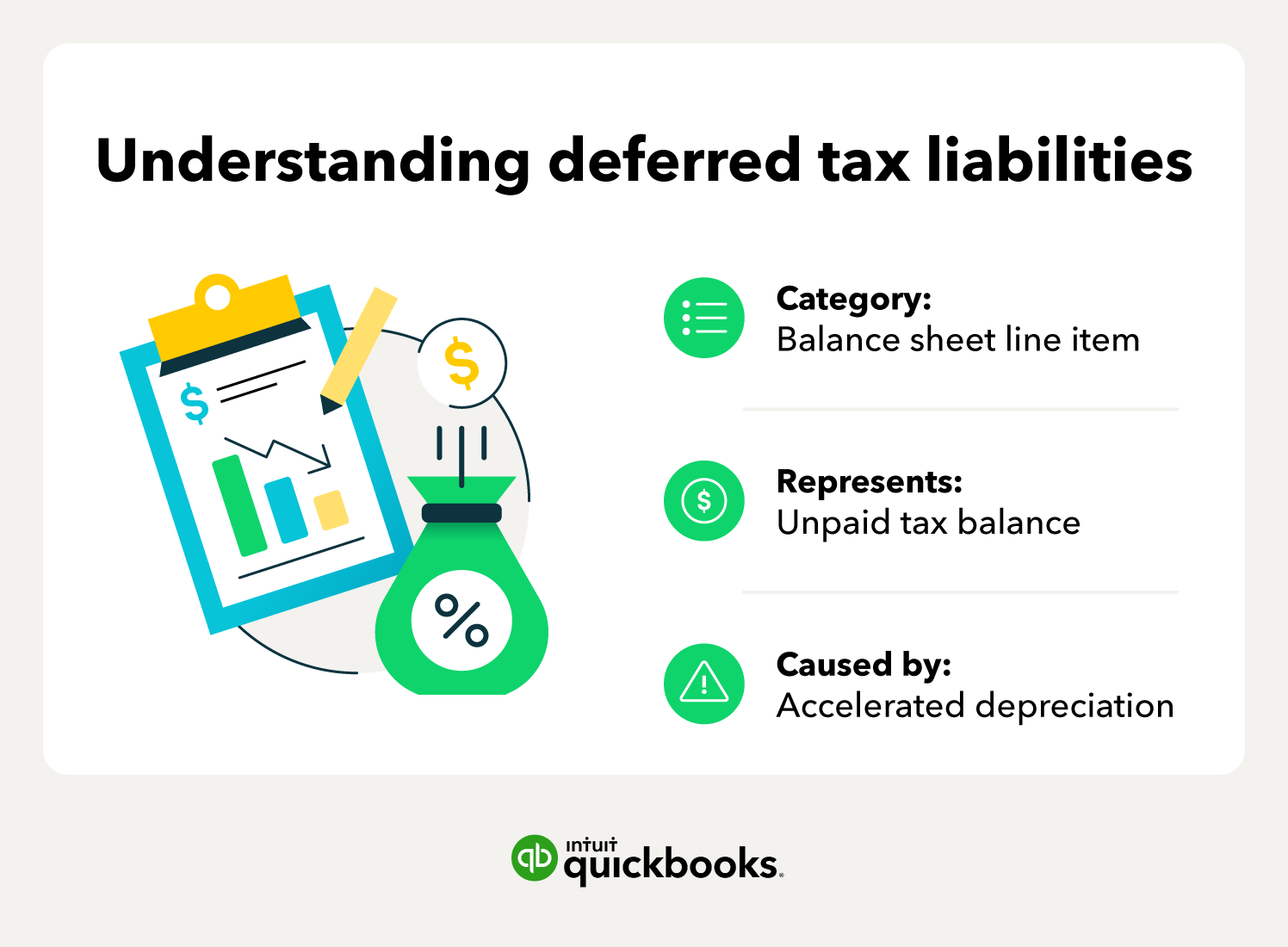

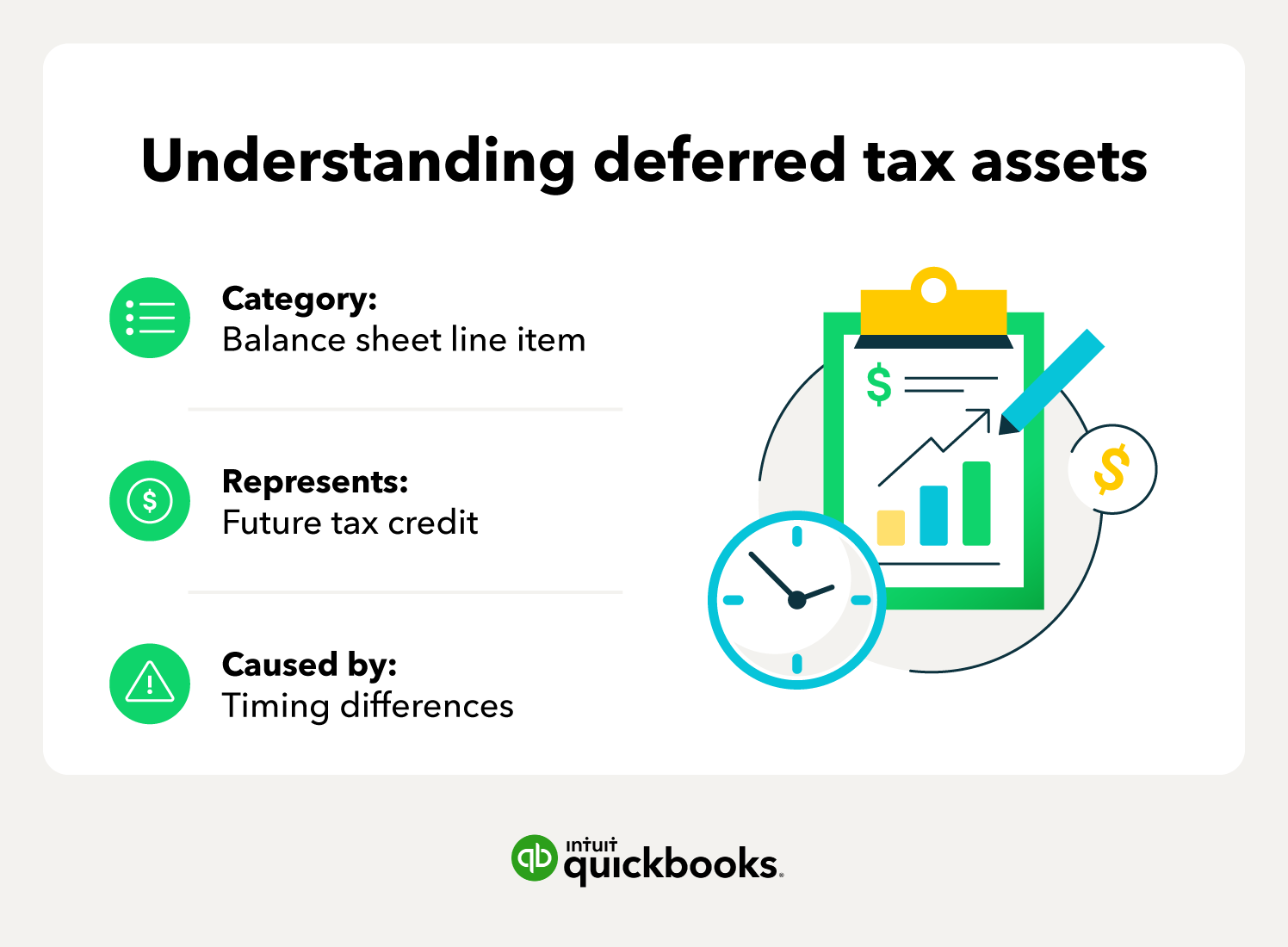

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

Complex Population Structure Of The Atlantic Puffin Revealed By Whole Genome Analyses Communications Biology

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

:max_bytes(150000):strip_icc():gifv()/Limited-partnership-4193607-FINAL-44ceeb8022a74d68a7c22bdb6abc2495.png)